Budgeting 101: From Zero-Balance Beginner to Budgeting Boss!

By Adedayo Oyetoke, Published on: February 24th 2024 4 min, 651 word Views: 1229

Living paycheck to paycheck can feel like a never-ending cycle, but fear not! Today, we embark on a budgeting adventure that will transform you from a wide-eyed newbie to a budgeting boss. Buckle up, because we're about to ditch the debt, crush your goals, and unlock the door to financial freedom!

Step 1: Unveiling Your Financial Landscape

Think of yourself as a financial detective. Gather your paystubs, bank statements, and any side hustle earnings. This is your financial blueprint, revealing where your money comes from and goes. ️♀️

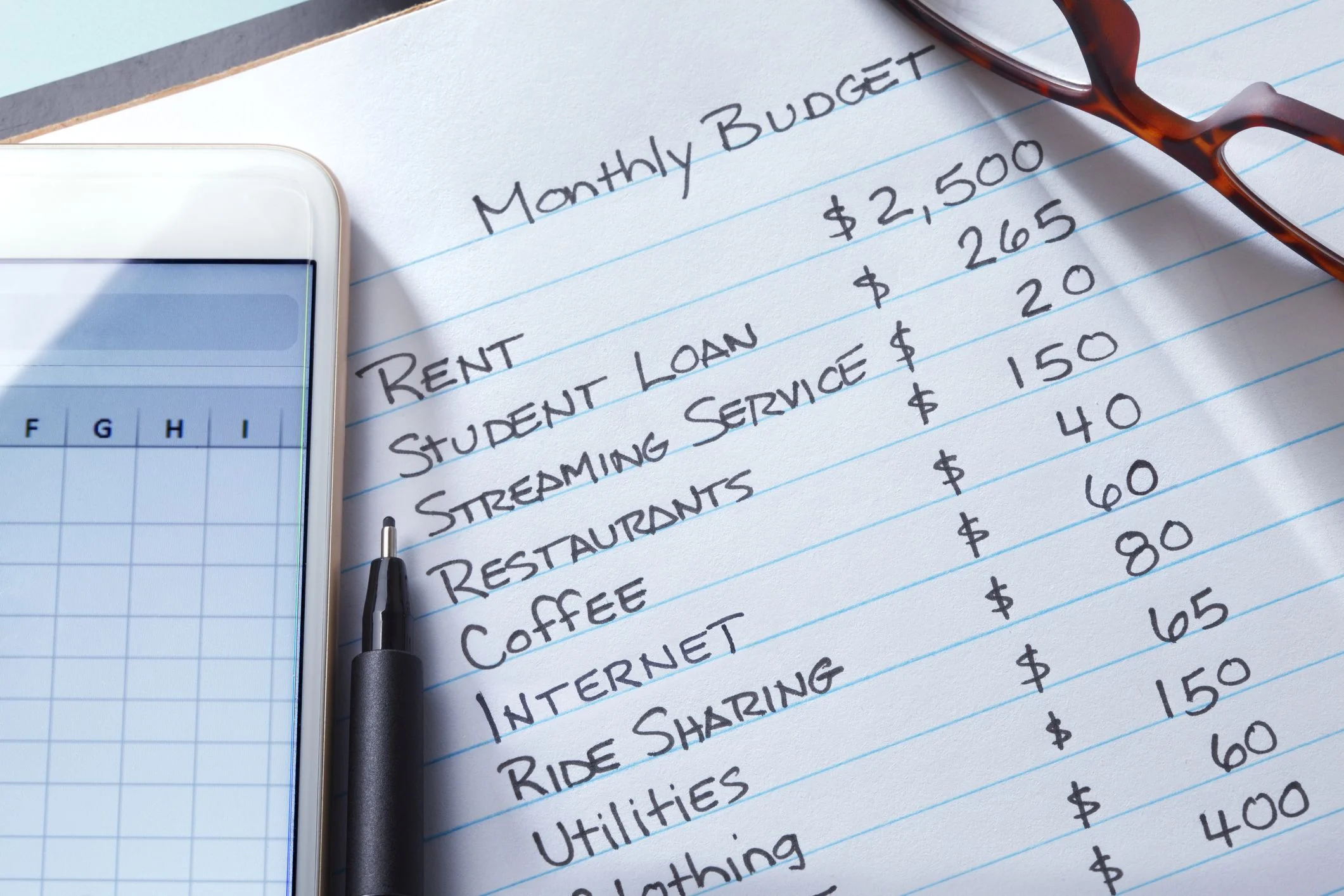

Next, become an expense explorer. Track every penny spent for a month, no matter how small (yes, that latte counts!). This might sound tedious, but it's crucial. Where does your money truly go? You might be surprised!

Finally, categorize your expenses into groups like rent, groceries, entertainment, and debt payments. This helps you visualize your spending patterns and identify areas for improvement. Think of it like color-coding your life – each category gets its own vibrant hue, making it easier to see where your money flows.

Step 2: Choosing Your Budget Weapon

Now, let's pick your budgeting weapon of choice! There are several options, each with its own strengths:

- The 50/30/20 Rule: This classic approach allocates 50% of your income to needs (rent, bills), 30% to wants (fun!), and 20% to savings/debt. It's a balanced and beginner-friendly way to start. Think of it like a financial pie chart, with each slice representing a key area of your life. ⚖️

- Zero-Based Budgeting: This method assigns every dollar a job before it's spent. Every penny is accounted for, making it ideal for detail-oriented folks and debt-crushing missions. Imagine your income as a team of soldiers, each assigned a specific task (like paying bills or building your savings) to conquer financial freedom. ⚔️

- Envelope System: Get physical with this method! Allocate cash to specific categories in physical envelopes. This tangible approach helps you track spending and avoid plastic temptation. Think of it like a real-life game of Monopoly, where you manage your cash in designated envelopes for each category.

Step 3: Tracking Your Progress & Plugging Those Leaks!

Budgeting isn't just about creating a plan; it's about tracking your progress and plugging those pesky spending leaks. Here's how:

- Apps & spreadsheets: Embrace technology! Utilize budgeting apps like Mint or YNAB, or create your own spreadsheet. Stay organized and accountable!

- Review & adjust: Regularly compare your budget to your actual spending. Did you stick to the plan? Identify areas for improvement and don't be afraid to adjust your budget as needed. Remember, your budget is a living document, not a rigid rulebook.

- Leak-busting tips: We all have spending blind spots. Ditch impulse purchases, explore free entertainment options, and cook at home more often. Automate your finances. Every penny saved is a step closer to your goals! Remember, small changes can add up to big results.

Step 4: Sharing, Supporting, & Celebrating!

Budgeting isn't a solo journey. Join the budgeting community! Share your experiences, challenges, and wins with others on forums or social media groups. Support and motivation go a long way!

Celebrate your milestones, big or small. Every step towards financial freedom deserves a pat on the back! Did you finally conquer that credit card debt? Did you reach your savings goal for a dream vacation? Treat yourself to a small reward to celebrate your progress and stay motivated.

Remember: Budgeting is a marathon, not a sprint. There will be bumps along the road, but with dedication, you can achieve your financial goals. So, let's conquer our budgets together and unlock a future of financial freedom! ✨

Now it's your turn! Share your budgeting experiences, challenges, or tips in the comments below. Let's build a supportive community and empower each other on this financial journey!

P.S. Don't forget to like and share this post to spread the budgeting love!

Bonus Resources: